The Impact of COVID-19 on Payments: Embracing Change

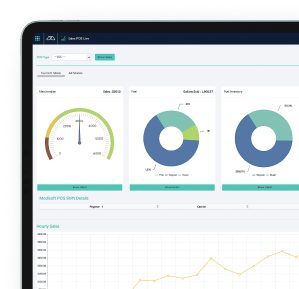

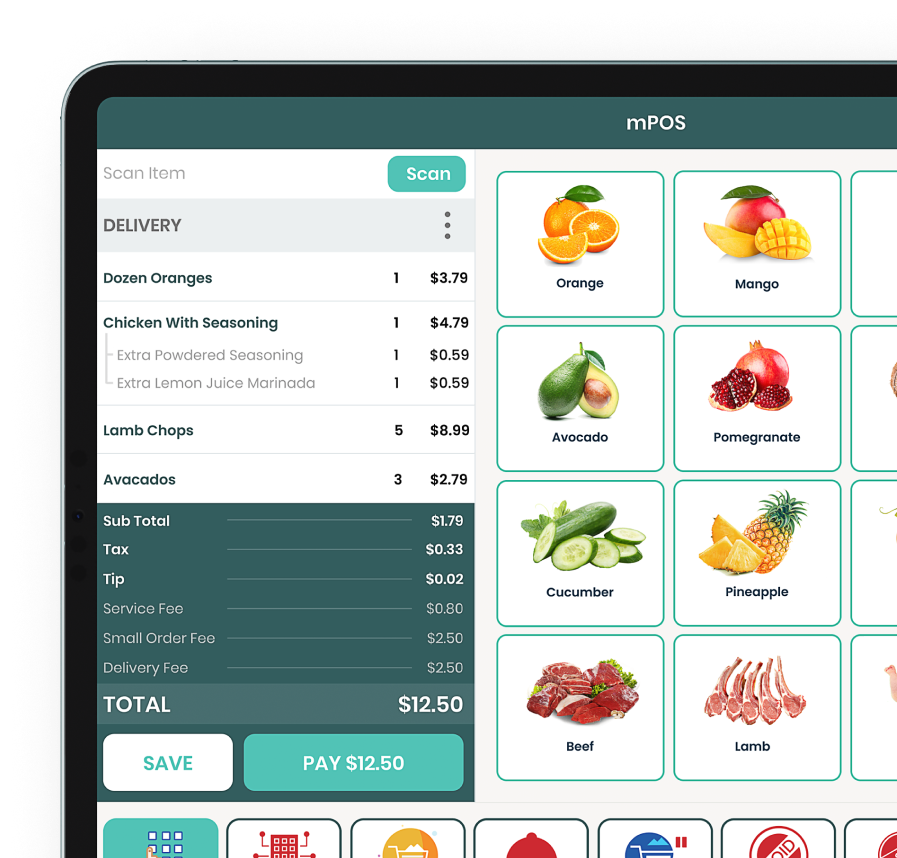

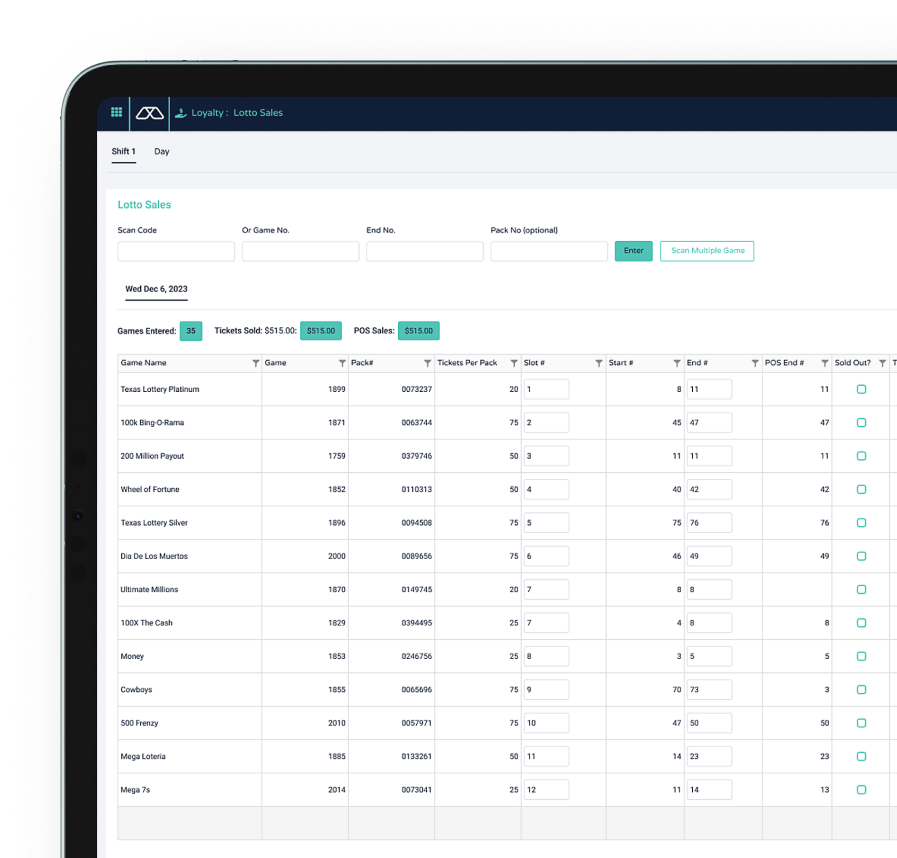

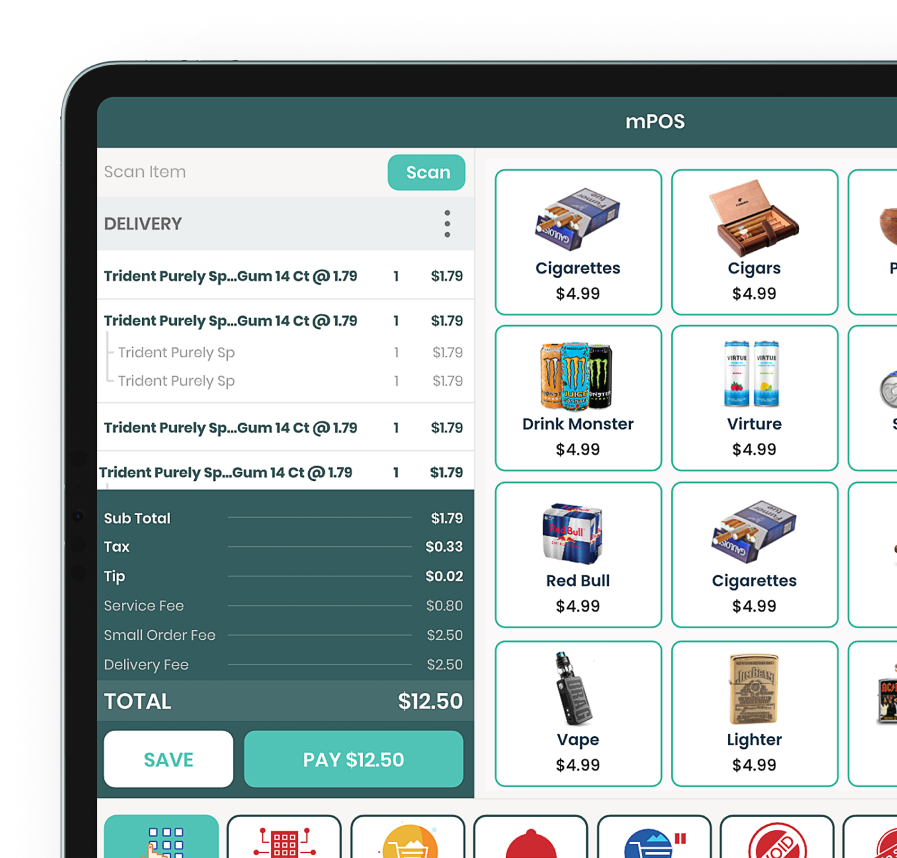

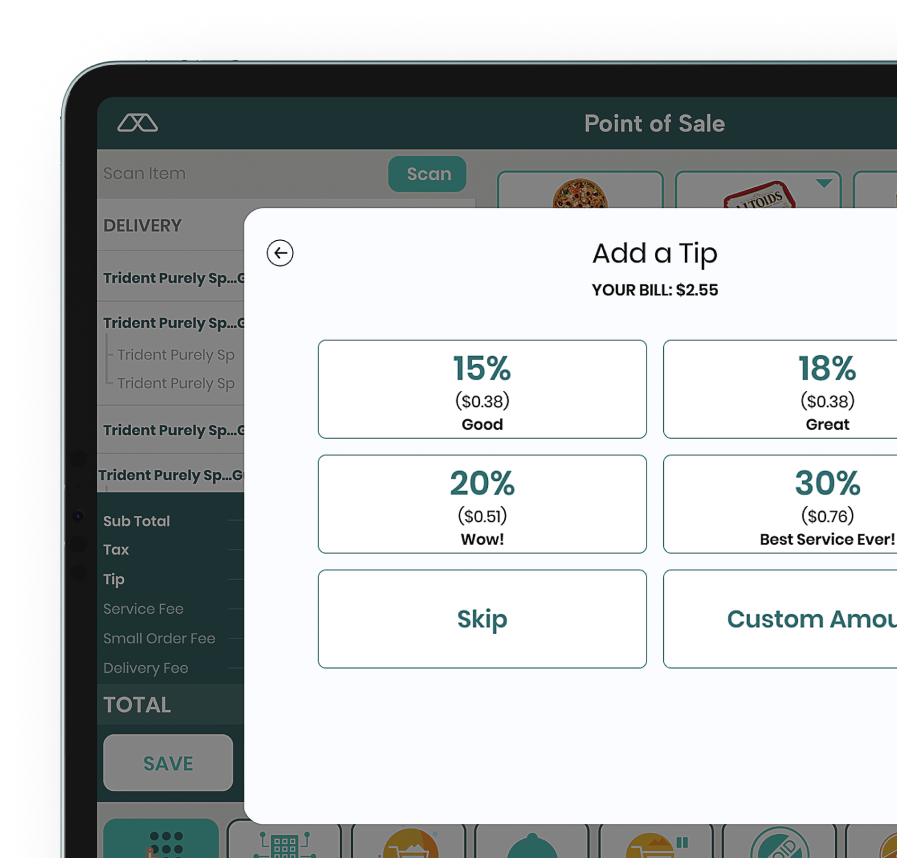

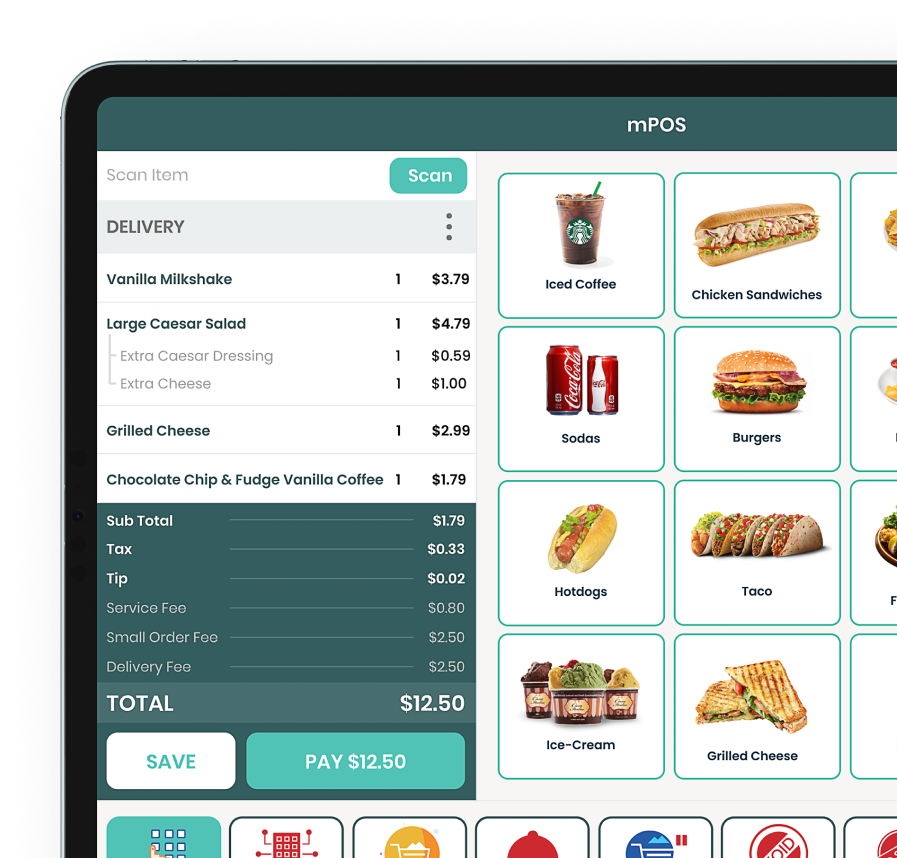

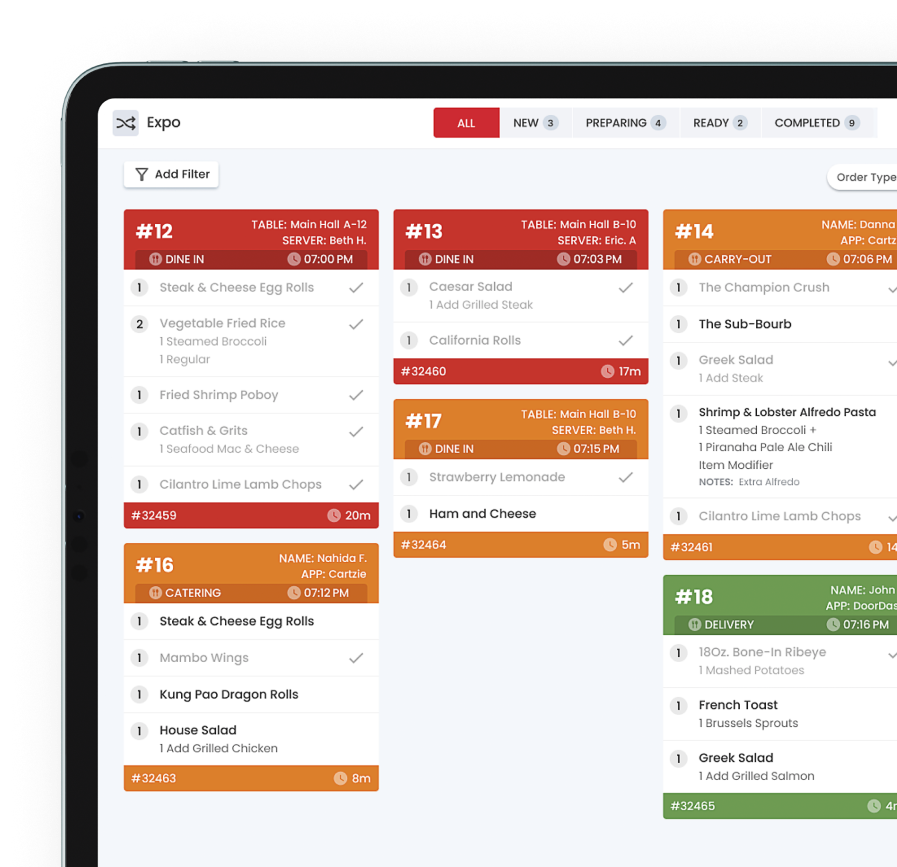

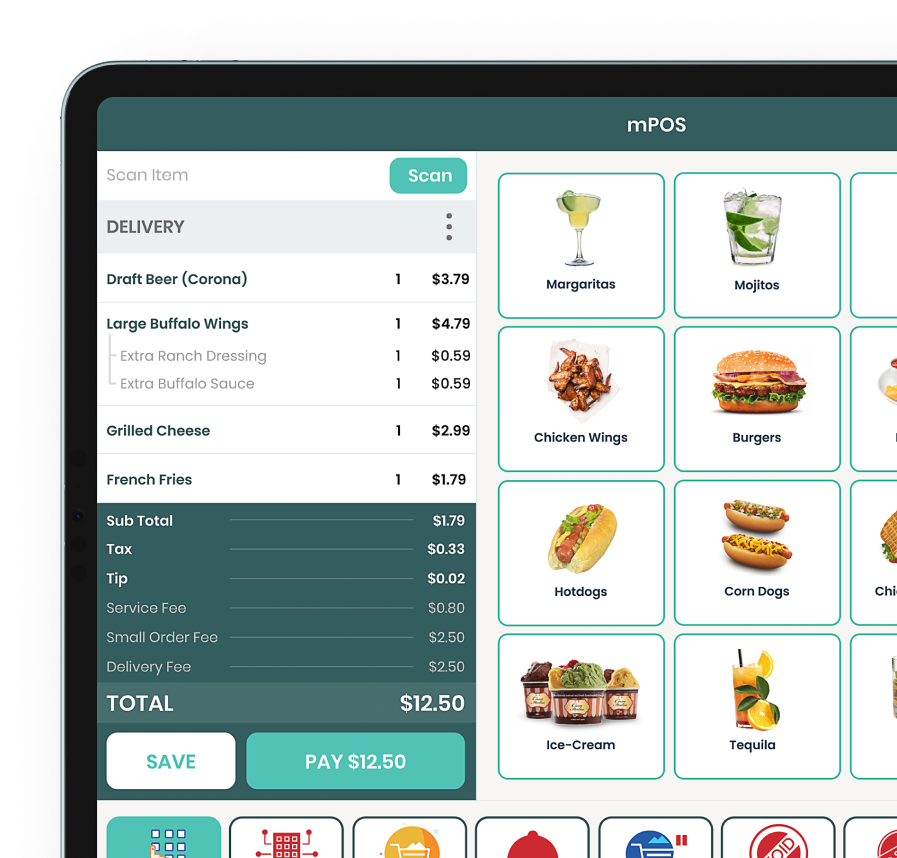

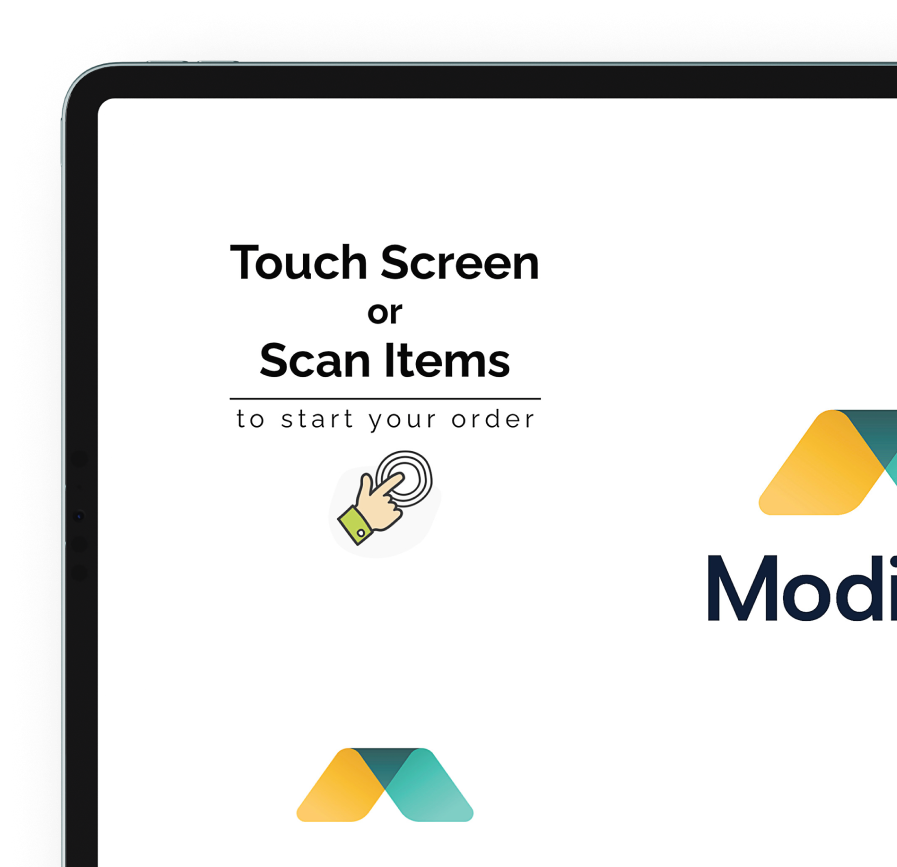

The COVID-19 pandemic unleashed a whirlwind of challenges upon businesses worldwide, and the payment industry found itself at the forefront of significant changes. With lockdowns, restrictions, and shifts in consumer behavior, the way we handle payments went through a profound transformation. One of the most striking changes witnessed during the pandemic was the noticeable decline in cash transactions. Fearing the risk of virus transmission, people increasingly turned to safer alternatives such as mobile wallets and card payments. This sudden surge in contactless payments underscored the importance of modern and secure Point-of-Sale (POS) systems. Convenience stores faced a unique set of challenges as essential businesses that remained open during the lockdowns. They had to rapidly adapt their payment processes to ensure the safety of both customers and staff. Implementing contactless payment options and enhancing hygiene at checkout counters became vital for their survival. Additionally, businesses across all sectors swiftly recognized the immense value of data insights pro樂威壯 vided by payment systems. The ability to analyze transaction data offered invaluable information about shifting customer behavior during this uncertain time. By identifying emerging trends, adjusting inventory levels accordingly, and optimizing marketing strategies, businesses managed to navigate the crisis more effectively. To adapt to the changing landscape, businesses swiftly prioritized upgrading their payment infrastructure with advanced POS systems designed to support contactless payments. Moreover, investing in robust back-office solutions that provide real-time insights into sales performance and customer preferences became crucial. Remaining agile was the key to survival in the face of the pandemic’s upheaval. Businesses had to be ready to adjust strategies based on emerging trends to ensure long-term success in an ever-changing market. Embracing innovative technologies, such as AI-powered fraud detection systems, became a necessity to safeguard against online threats while ensuring secure payments. In conclusion, the COVID-19 pandemic accelerated the digital transformation within the payment industry. Businesses, in the face of adversity, embraced change wholeheartedly, adopting advanced POS systems to facilitate contactless payments and harnessing data insights for informed decision-making. Those who managed to remain agile and invest in technology now find themselves well-equipped to thrive in the post-pandemic payment landscape. The valuable lessons learned during these challenging times will continue to shape the future, ushering in an era of secure, convenient, and customer-centric payment experiences. As the world embraces the new normal, the payment industry stands poised to lead the charge towards a more resilient and digitally connected future.