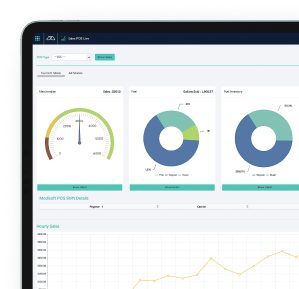

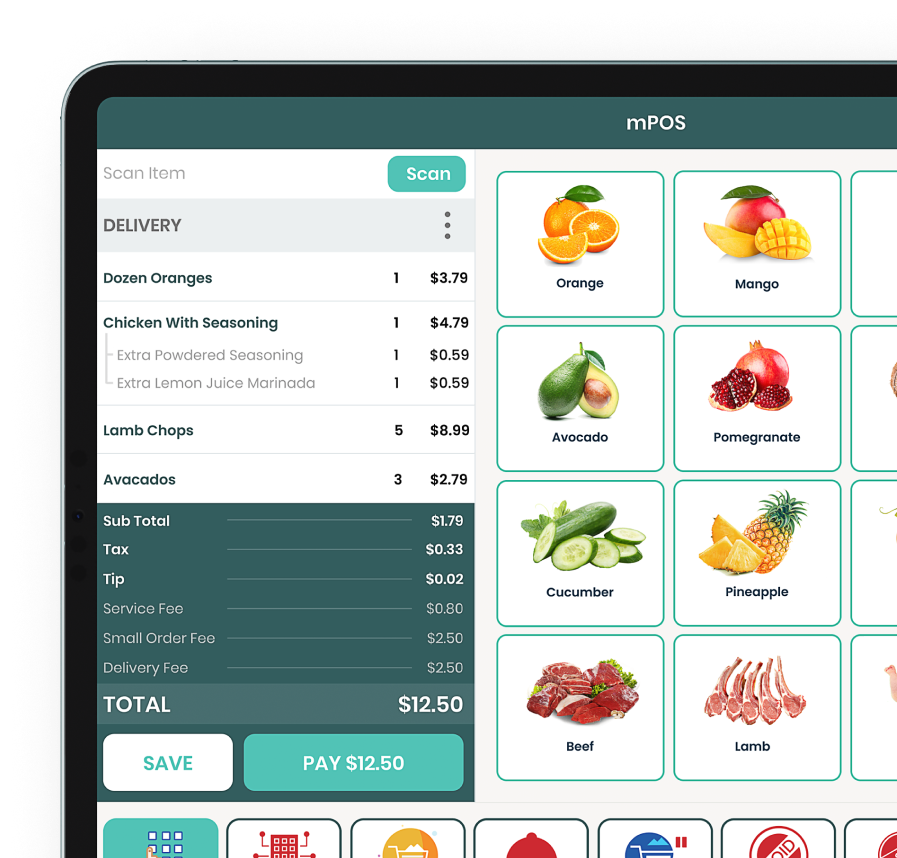

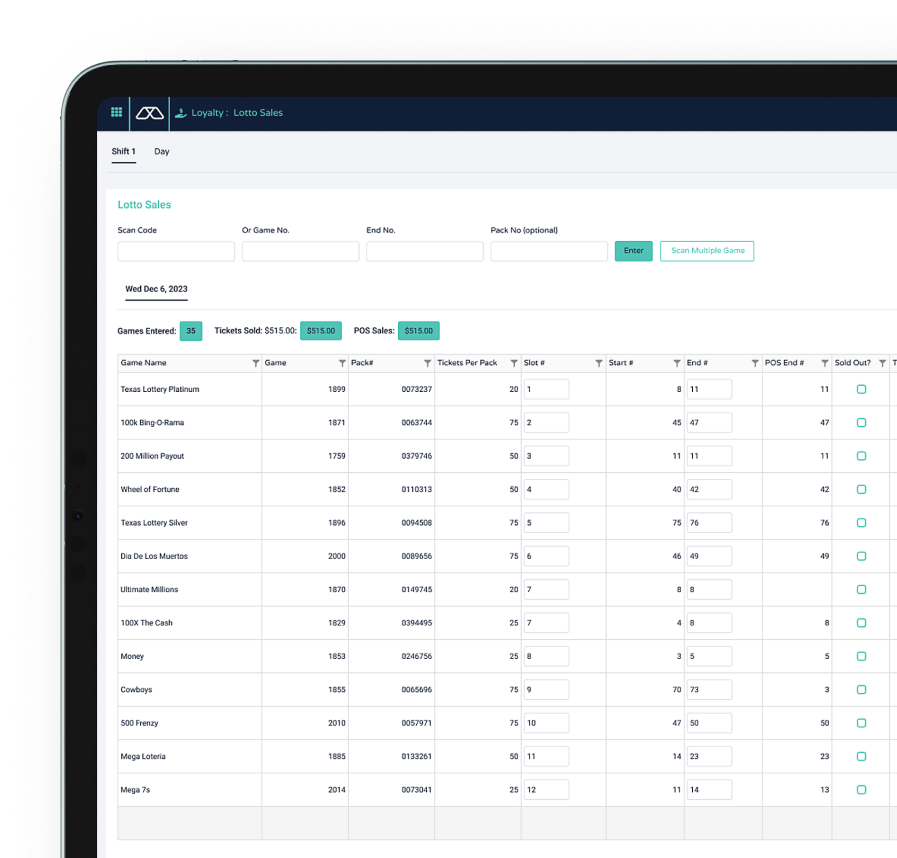

The usage of Point of Sale (POS) systems has transformed the way businesses execute transactions and conduct their operations. Cloud-based POS systems, which have been developed with advancements in technology, are now considered a potent solution for companies irrespective of their size. In this blog post, we will examine the advantages of cloud-based POS systems and investigate how these systems provide immediate data insights, remote management abilities, and scalability.

Convenience at Your Fingertips:

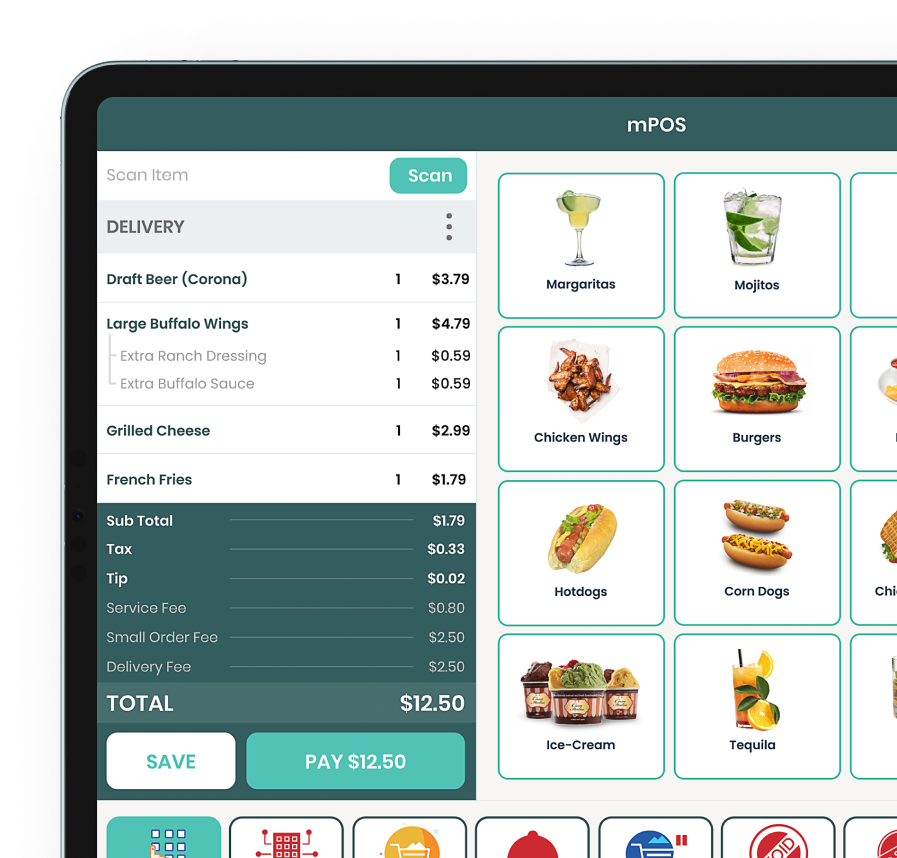

Mobile payments offer a hassle-free alternative to digging through wallets for the right card or scrambling for cash. With just a few taps on your phone, you can easily make purchases whether you’re buying groceries, dining out, or shopping online. The convenience of mobile payments extends to travel as well, as several currencies can be used without the need for exchange. Digital wallet software seamlessly integrates with mobile payments, allowing users to manage various payment options in one place. Thanks to digital wallets, credit card information, loyalty programs, and even gift cards can all be stored in one location, streamlining the payment process. Users can also effortlessly switch between multiple accounts and simplify budgeting by accessing and organizing a variety of payment options through a single mobile app.

Enhanced Security Measures:

When it comes to financial transactions, security is a top priority for consumers. Luckily, many mobile payment systems have innovative security features to protect sensitive data and lower the risk of fraud. These systems often use encryption technology, fingerprint or face recognition identification, and tokenization to safeguard user and payment information. Additionally, because no physical cards are required for mobile payments, there is less risk of card theft or loss.

Mobile payments also have the potential to improve security by preserving digital records of transactions. Unlike traditional cash transactions, mobile payment apps can produce electronic receipts that give users a clear picture of their purchasing habits. This feature is especially helpful during tax season, as people can easily access and categorize their spending for accounting purposes.

Access to Rewards and Offers:

Mobile payment systems often incorporate loyalty programs, special offers, and prizes, which add extra value to customers. By linking their payment methods to these programs, users can earn rewards in the form of points, cash back, or discounts on their purchases. These incentives can then be used to lower the cost of future purchases, enhancing the overall shopping experience. Furthermore, personalized offers and recommendations based on individual shopping patterns are provided by mobile payment apps, which further enhance customer satisfaction and engagement.

Mobile payments offer numerous benefits for consumers. They have revolutionized financial transactions by providing fast and convenient payment options, as well as increased security measures. Mobile payments have now become an essential part of our daily routine due to their accessibility in terms of incentives and offers, connectivity to digital wallets, and efficient record-keeping abilities. As technology continues to advance, consumers should embrace the convenience and advantages of mobile payments. By doing so, they can enjoy a streamlined and secure payment process while also gaining access to potential savings, benefits, and better financial organization.