Whether you are running a QSR, full-service, or fast casual restaurant, there is always one goal in mind – gain more customers for sustainable growth. When you are on the path to growth, a big chunk of your budget will go toward marketing and advertising to reach new diners/customers.

However, to know how effective your marketing campaigns are, you have to determine the customer acquisition costs.

When customer acquisition costs are high and customer lifetime value is low, it ultimately breaks down your bottom line. Therefore, it is vital to strike the right balance and keep your expenses in check.

This blog aims to help you make your marketing efforts count by sharing the proven tactics to reduce your CAC.

What Is Customer Acquisition Cost & How to Calculate It

Customer acquisition cost or CAC is the total amount you spend to acquire new customers.

It is one of the important business metrics that lets you know whether the total amount you spend on acquiring new customers outweighs the money you make.

In simple terms, customer acquisition cost is designed to measure and maintain the profitability of your business. Calculating your customer acquisition cost can be challenging, but there are online tools, such as the Restaurant Marketing Calculator, to help you calculate it properly.

How to Reduce Customer Acquisition Cost

Almost all businesses depend on customer acquisition. However, the cost associated with CAC can significantly impact your business profitability. As a result, business owners need to explore more ways to minimize the cost involved with acquiring customers.

Here are 5 proven ways that can help you to reduce customer acquisition costs.

1. Test Your Options

The first step towards reducing customer acquisition costs is to know which method works for you. The best way to find out is by testing your options. You need to find out which option appeals to your target audience and turns more customers in.

However, when testing marketing options, don’t try all the options at once. For instance, if you want to test Google Ads, Facebook (Meta) ads, or consider going with billboard advertising make sure to try one by one and then compare all the results with each other to know which method works.

This is one of the smartest moves to determine which channel gives you better results and will ultimately reduce your customer acquisition cost.

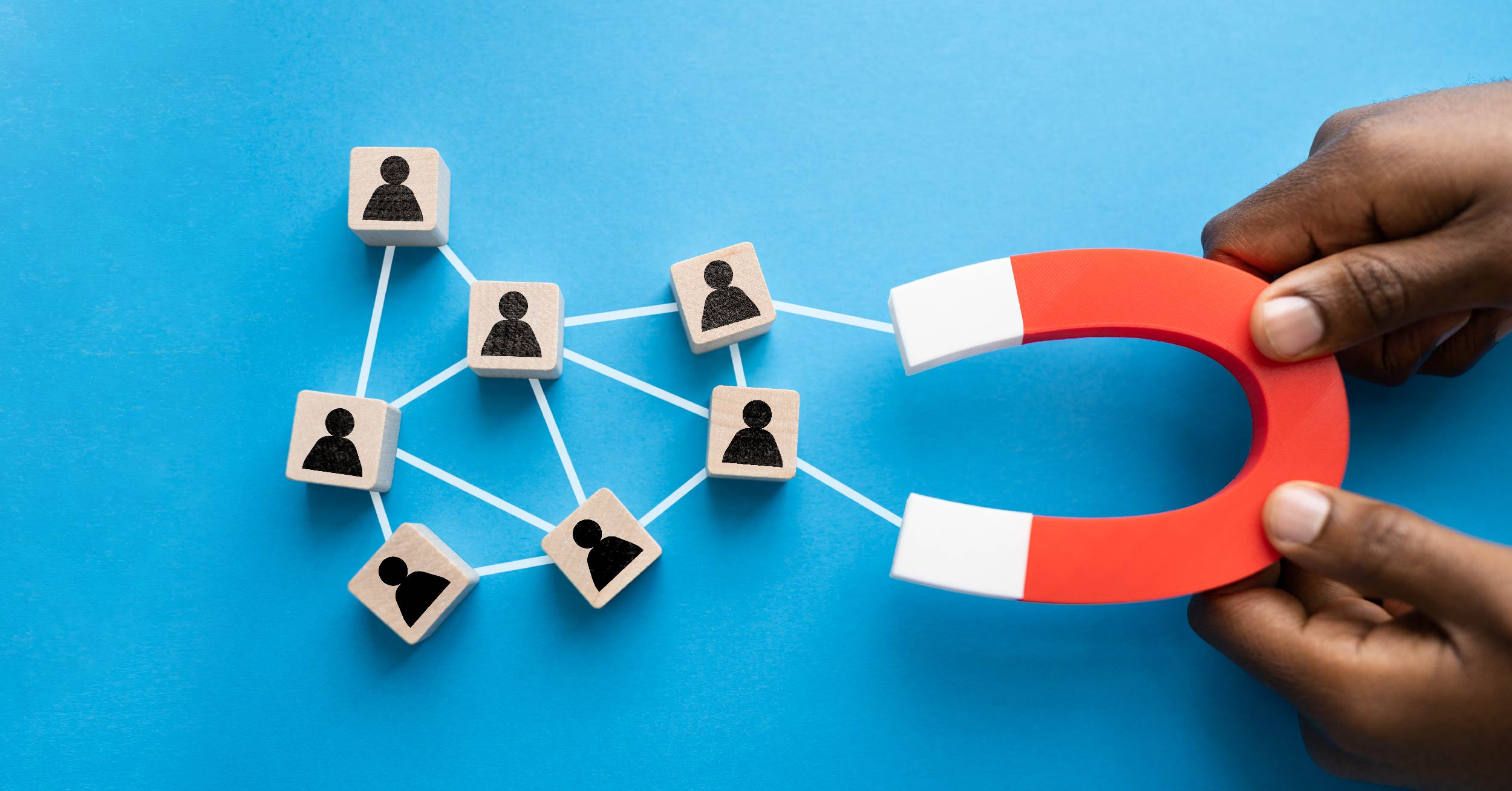

2. Try Referral Programs

Did you know having a referral program can significantly reduce customer acquisition costs? Having a robust referral program in place allows you to get warmer leads and helps you obtain prospects who are already familiar with your business. This minimizes the cost you spend on acquiring new customers.

To increase recurring sales, you can introduce a loyalty reward system that can help you create loyalty campaigns and entice your customers to come back for more.

3. Push Organic Social Media Growth

Organic social media growth is the key to reducing your customer acquisition cost. Businesses can leverage user-generated content (UGC), share and create valuable content that resonates with the audience, and easily convert viewers into customers. To achieve this, you need to align topics, channels, and formats with your target market.

Once you start increasing your organic followers, you’ll soon be able to convert them into a target audience. Remember to keep checking your organic social media growth by monitoring and analyzing which type of posts are working for you.

4. Track Your New Customers

Keeping track of your new customers is essential to know the progress of your marketing. However, it can be difficult for you to know your new customers when using a paper-based order-taking system. Therefore, to make sure that you can easily track your new customers you need to adopt either of the two solutions given below.

- Credit Card Tracking: A smart POS system integrated with credit card processing can help you make a database of your customers. You’ll easily track your new customers, as well as those who make repeat purchases.

- Online Signups: By using a custom website and app you can easily know new signups. This can help you to get an estimate of the new customers that order from your restaurant. It’s a smart way to track your new customers and know exactly how many customers you gain.

5. Invest In SEO & Digital Marketing

To reduce your customer acquisition cost it is important to find new and cost-effective ways to acquire fresh customers. Digital marketing and SEO can help you reduce your costs. By simply claiming your page through Google My Business, and pushing for reviews, you can gain customers through Google. Meanwhile, by practicing SEO you can rank on certain keywords your customers are typing to search restaurants and grab more audience.

Make Informed Decisions by Using the Best CAC Practices

Your business is dependent on new customers. However, acquiring customers by spending more money without knowing where it’s going, won’t help you to drive business growth. By using the right tools and following the above strategy you can drastically decrease your customer acquisition cost.

FAQs

- What is a Good Customer Acquisition Cost?

- What is The Difference Between Cost Per Acquisition & Customer Acquisition Cost?

- Why Is It Important to Calculate CAC?