Starting a small business can be challenging, especially in today’s global economy. Nearly 20% of businesses fail within their first year, and only half make it to five years. With adequate research and a willingness to understand the nuances of running a business, there is room for success in your business idea.

In this guide, you will learn 8 simple steps to get your business started. With the right steps in place, you can grow your business idea and find success.

1. Conduct Market Research

Conducting market research helps you understand the competitive landscape you are entering into. Whether you have a physical location or are strictly an eCommerce store, there are always competitors who are similar to your business idea.

Learn what those competitors are doing to understand the industry you are entering into better. What companies inspire you? What would you do differently than other stores? Keep an accurate record of your findings and write a summary of your research. If you ever feel stuck in honing in ideas, your market research can help you make a plan moving forward.

2. Write a Comprehensive Business Plan

A comprehensive business plan can take a lot of time and careful consideration. A business plan summarizes everything about your business and what it needs financially to operate at its best.

Aspects to include in a business plan include,

- Executive summary

- Mission statement

- Environment considerations

- Market analysis

- Competitive analysis

- Management plan

- Financial plan

- Product lists

- Potential investors

By knowing exactly what your business needs in your plan, you can keep on track for a successful start to your small business.

3. Consider Accounting Options

The type of business you start can affect how you pay taxes, raise money, and the personal liability involved. Many small business owners talk with an accountant or attorney first to understand better how opening a small business affects their finances.

Types of Businesses

Sole Proprietorship: A sole proprietorship gives you complete control of your business. This type is not considered to be a separate business entity, which means your business assets and liabilities are connected to your personal assets and liabilities.

Partnership: A partnership involves two or more people who own a business together. This can be a limited partnership (LP) or a limited liability partnership (LLP). An LLP helps protect a partner from potential debt that the other partner may accrue.

Limited Liability Company (LLC): An LLC combines the aspects of corporation and partnership structures. This type protects personal assets such as vehicles, houses, and savings accounts. Keep in mind LLC is still considered to be self-employment, which means you have to pay self-employment tax.

C Corp: C corp means a corporation and is a legal entity that is entirely it’s own. Corporations are able to make a profit, pay taxes, and can be held legally liable. It is the strongest type to protect personal assets, but also requires more acute reporting.

S Corp: S corp is a subchapter corporation that is created to avoid taxation complexities. S corps are allowed to gain profits, experience some loss, and be passed to a business owner’s personal income.

4. Register Your Business

After deciding what type of business works best for you, then it is time to register your business. Registering your business creates a tax ID number, otherwise known as an employer identification number (EIN). This helps track your business for tax reasons, but keep in mind that if you are not a corporation or partnership, you will not have to register for an EIN.

Make sure to register your business in the state you are in, as income and employment taxes differ per state. Talk with your attorney or accountant to further understand what is required to fully register your business.

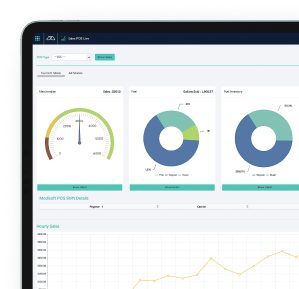

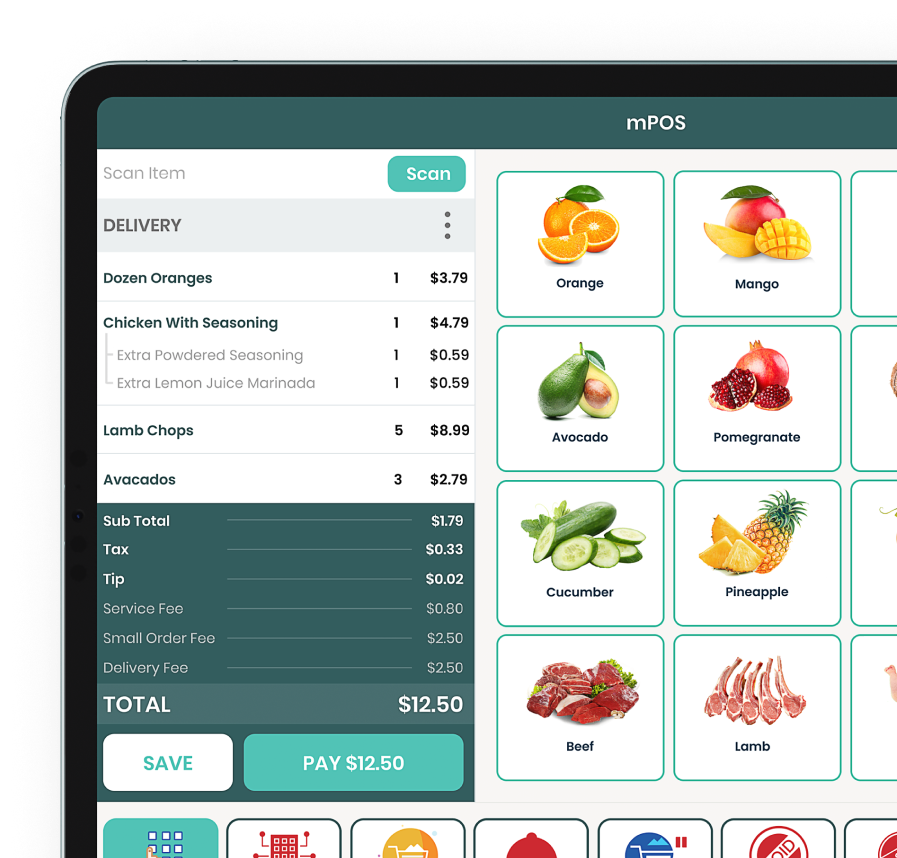

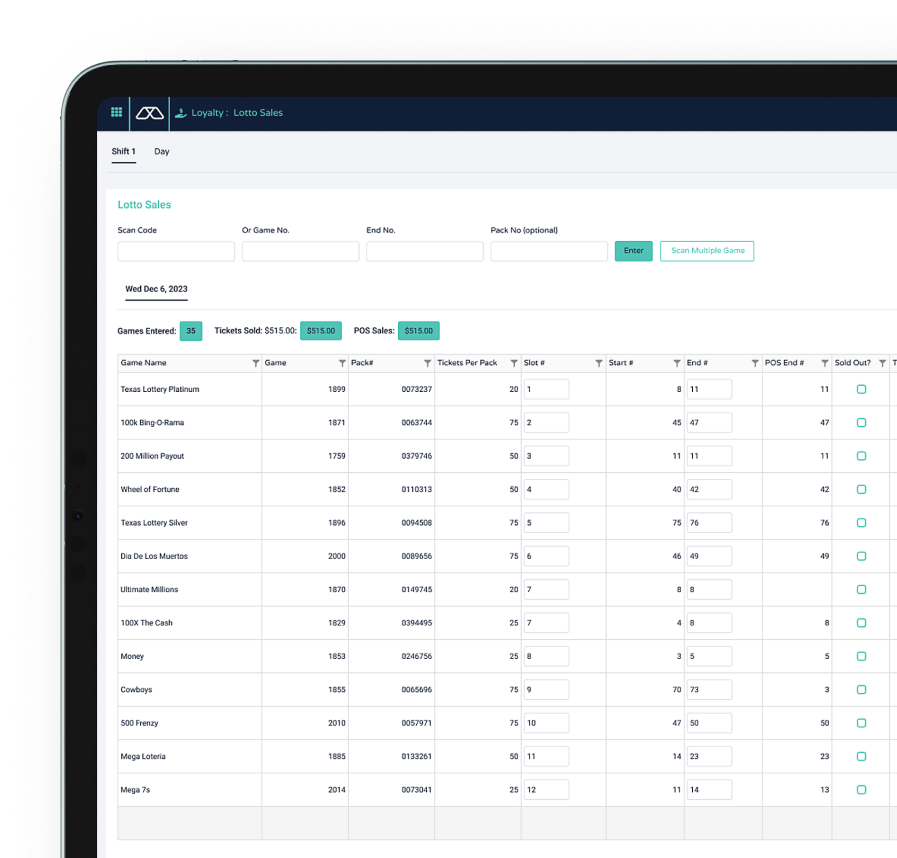

5. Consider Payment Options

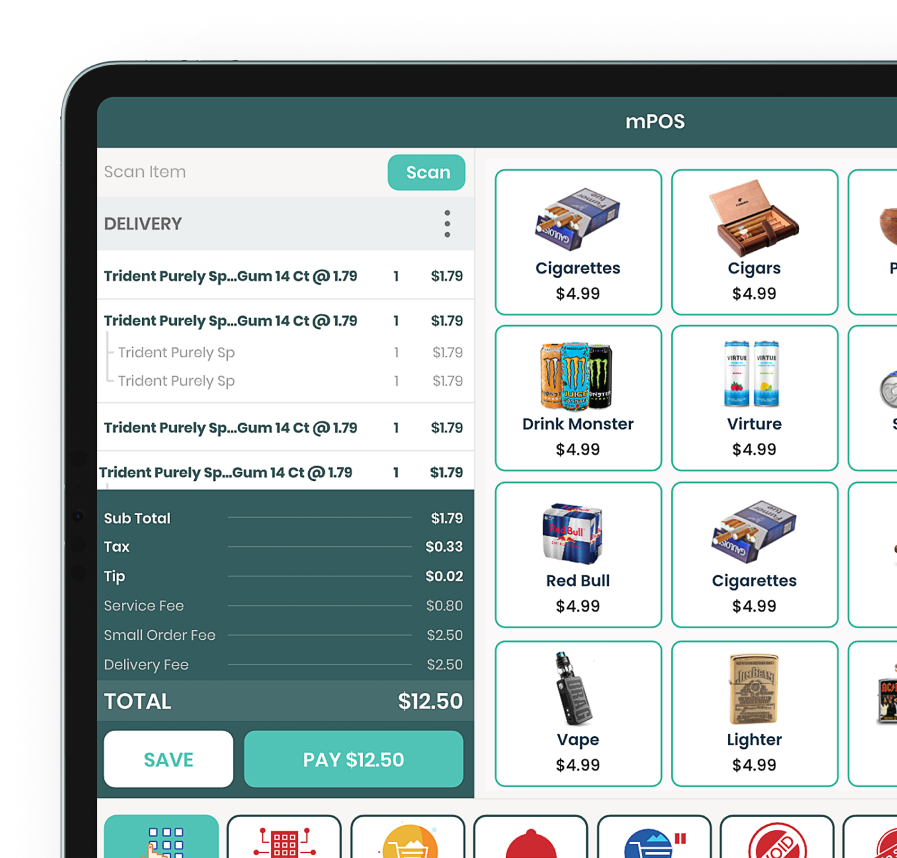

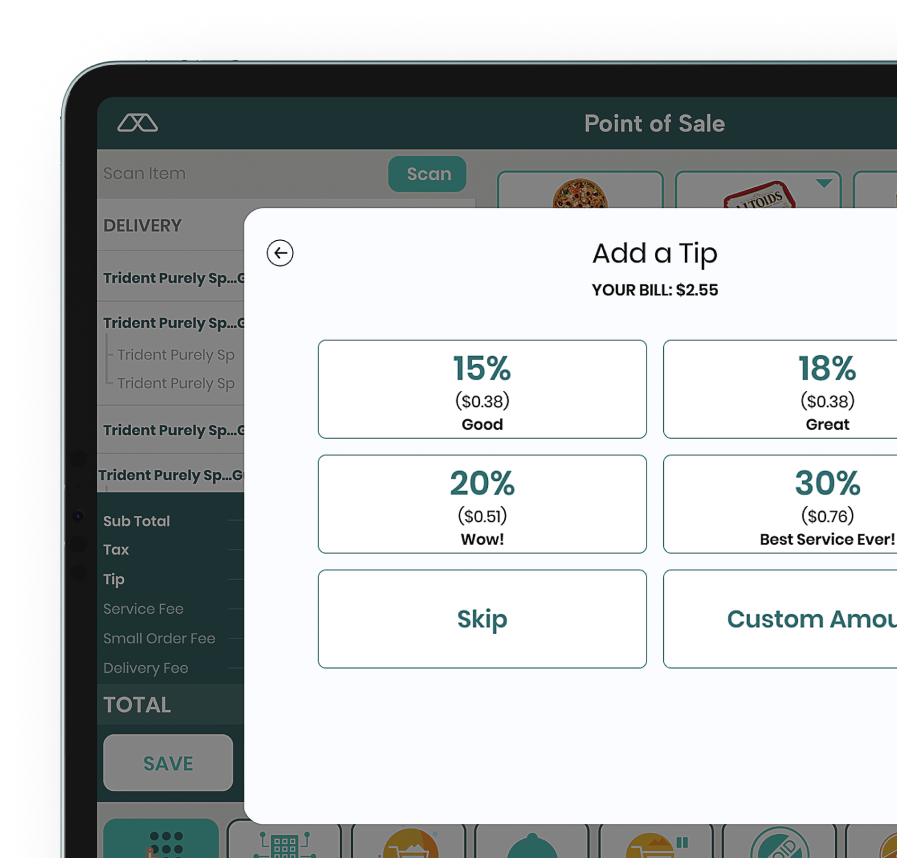

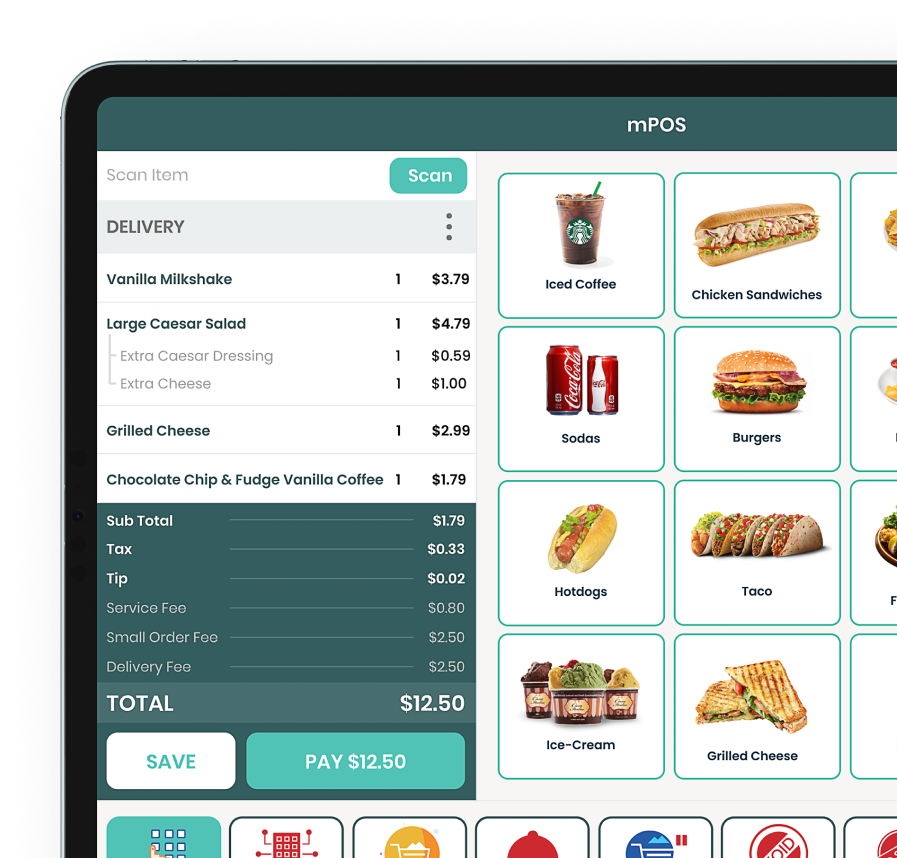

Setting up payment options for future customers can seem like a daunting task, but it can be made very simple with a POS system, merchant account, or payment gateway account. More customers are utilizing debit or credit cards, which makes it a key aspect that is needed when starting a small business.

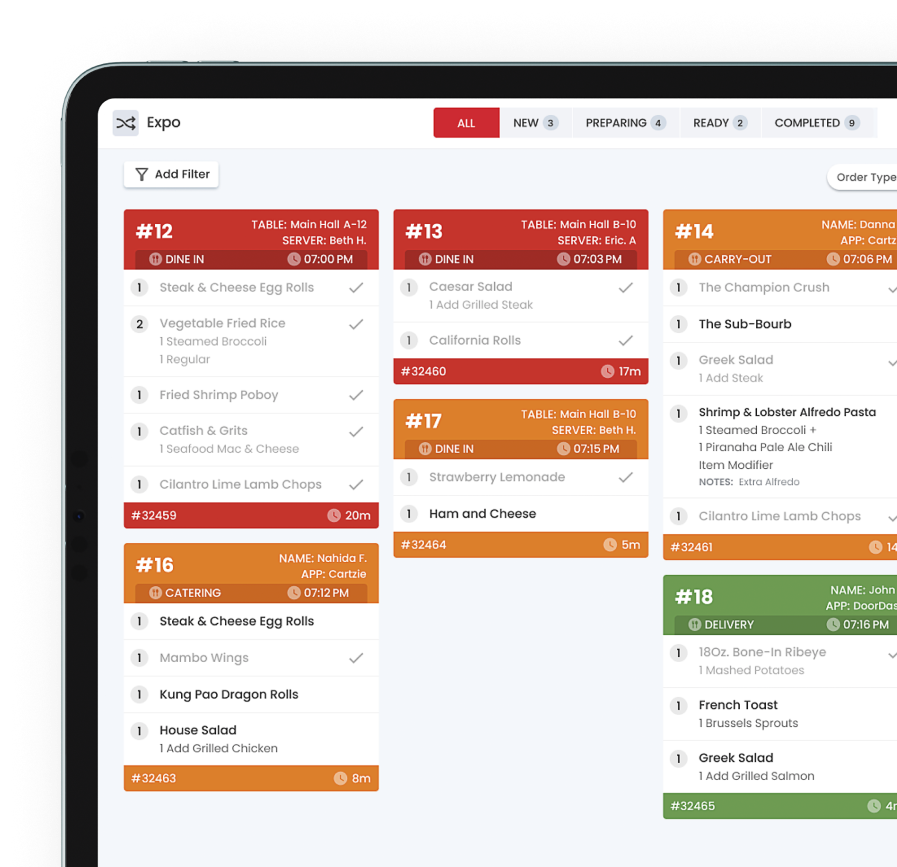

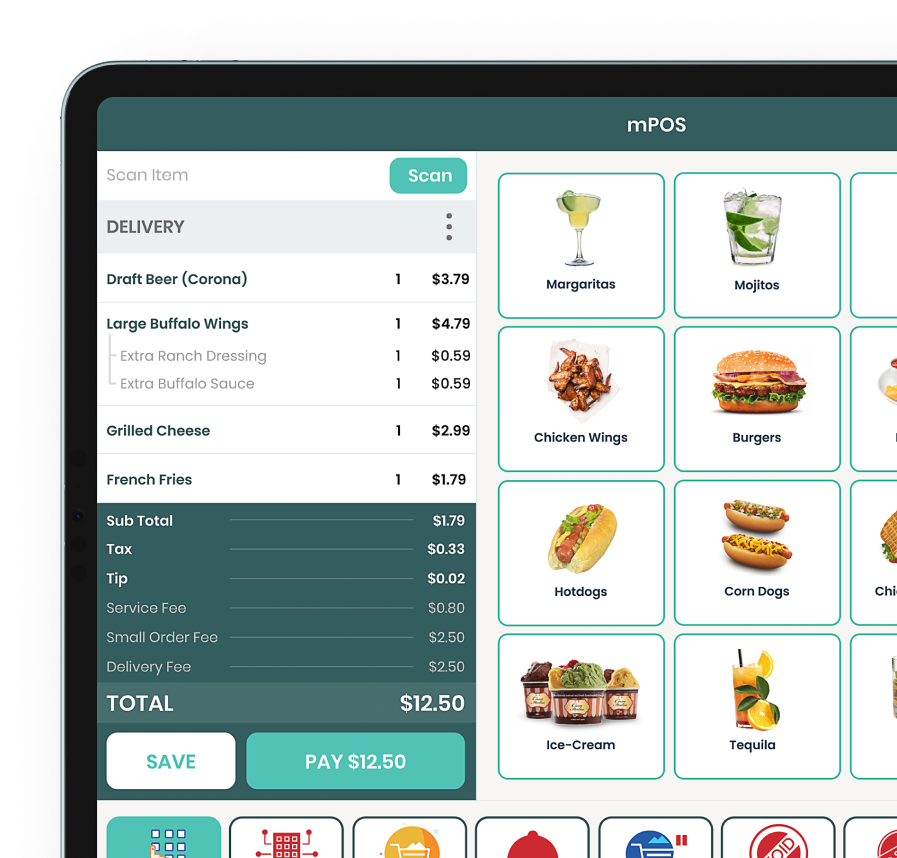

Choose a credit card machine or point of sale (POS) system that works best for your business model. More advanced POS systems like Modisoft are able to offer inventory management, as well as manage schedules and regular reports, which can help you increase profits. There is also the option to set up a merchant account or create a payment gateway account. In the US, eCommerce represents 10% of retail sales, which means online sales are becoming even more crucial for businesses to adapt to. With a payment gateway, there is the ability to encrypt data and ensure that the information is secure for customer payments.

However you choose to collect payments, make sure to check for any hidden fees or transaction minimums before signing up for a service.

6. Apply for Licenses or Permits

There are regional, state, and federal licenses and permits to consider before you can open your business. Depending on the type of business you plan to open, the type of permit will differ. If you are opening a restaurant, you will have to consider a food handler’s permit, as well as a liquor license. For retail, the licenses may differ depending on what state your business is located in.

7. Define Your Business Concept

Define your business concept down to every detail before you consider opening the doors to your business. Consult your original business plan and make sure you are on track with your financial plan, product line, or menu items that should be considered beforehand.

The more you can define your business, the more customers will be able to identify with your brand. In turn, you can create a loyal base of customers who believe in your business and continually want to purchase more from you.

8. Open The Doors

Once you have everything in place, you can open the doors. Ask for customer feedback and consider an online system that creates more opportunities for customer outreach and sales. Keep a close eye on competitors to stay ahead of the game and make sure to utilize technology to its fullest to ensure your business has longevity.